Where are the DC-CFA data centres?

It's 260 days since the 4 DC-CFA winners were announced. None have started building yet.

It's 260 days since the 4 DC-CFA winners were announced. None have started building yet.

Last July, I wrote a post about the most closely watched day in the Singapore data centre industry.

IMDA on 14 July 2023 announced the winners of the pilot Data Centre - Call for Application (DC-CFA) exercise, awarding a total of 80MW to four winners.

- AirTrunk-ByteDance (Consortium)

- Equinix

- GDS

- Microsoft

Read 'The most closely watched day': https://lnkd.in/gEGUi5AG

🤝 A big deal

Why was it such a big deal?

Singapore has imposed an "implicit" moratorium on new data centres since 2019. It ended early last year with the announcement of a programme for new data centres.

Only approved proposals can go ahead, and these were awarded based on criteria such as:

- Energy efficiency.

- Sustainability goals.

- International, local connectivity.

- Economic benefits beyond DC capacity.

I observed then that the bar for new data centres in Singapore is now extremely high, beyond the ability of independent players, no matter how well-funded.

Regardless, one would expect a flurry of activity as the winners rush to build. After all, at 1.65%, Singapore has the lowest data centre vacancy in the world.

Read 'The minuscule 1.65% data centre vacancy in Singapore': https://lnkd.in/guCrU7WS

🤔 What happened?

What happened was: Nothing.

To my knowledge, none have started work on any construction, and no announcements were made beyond initial statements.

Data centres are hush-hush matters, but I did some asking around with some industry sources. Still nothing.

(Actually, I don't quite get the secrecy, since it's pretty hard to hide an entire data centre. The firms involved in building data centres are typically specialists, too, so it's not like you can pretend to be building a warehouse)

So why nothing?

🔋 The search for power

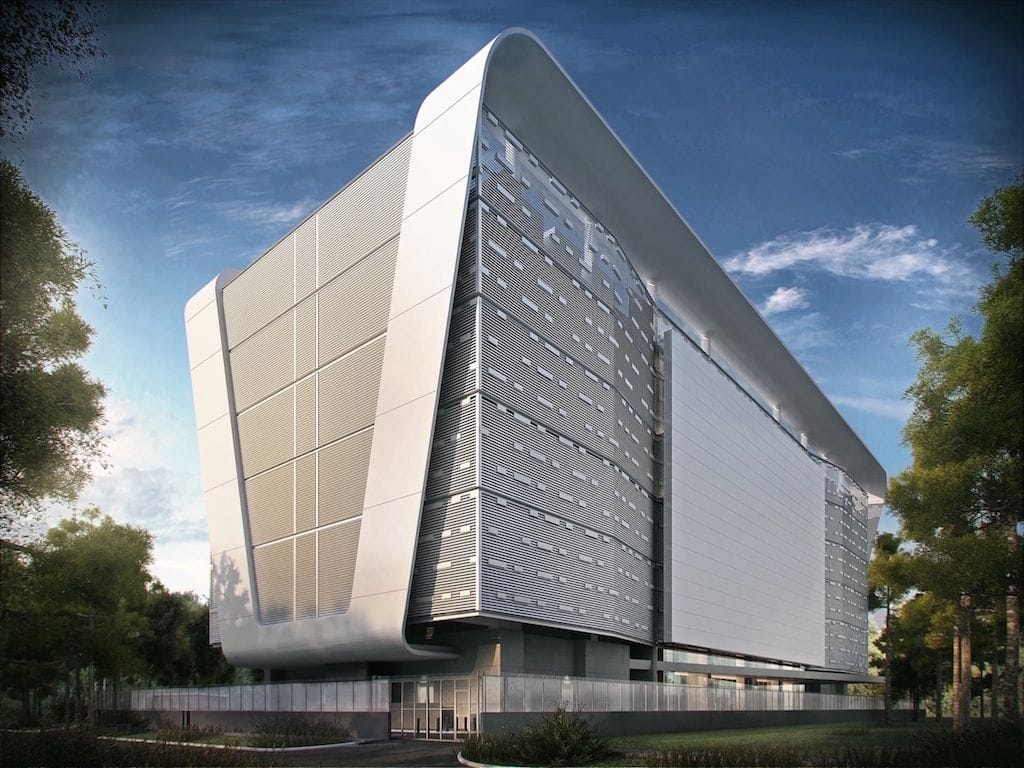

Data centres are power-hungry facilities, more so with the latest generations of hyperscale data centres.

Granted, 20MW per data centre is not that much these days. Still, it is a non-trivial amount that needs to be provisioned from a nearby power substation.

But what if all nearby substations are already maxed out?

I imagine if I were them, I'll just have to wait.

Interestingly, I'm hearing that this is also the case in Johor, which has surplus power, but where the power infrastructure might not be in place to deliver it to chosen data centre sites.

Of course, I might be wrong about the DC-CFA. Do shoot me a DM if some of the winners have already started building their data centres.