GDS International is now DayOne

Would it be enough to avoid new US regulations?

GDS International is now DayOne, as it focuses on Johor, Singapore and Batam - and other parts of Asia. But is this enough to distance itself from GDS?

According to a report on Mingtiandi, DayOne will have separate corporate governance, operations, finance, and technology functions from its mainland China parent.

The SIJORI hub

DayOne has grown rapidly over the years with operational data centres in Johor and Hong Kong and at least 5 other data centres coming online over the next 2 years.

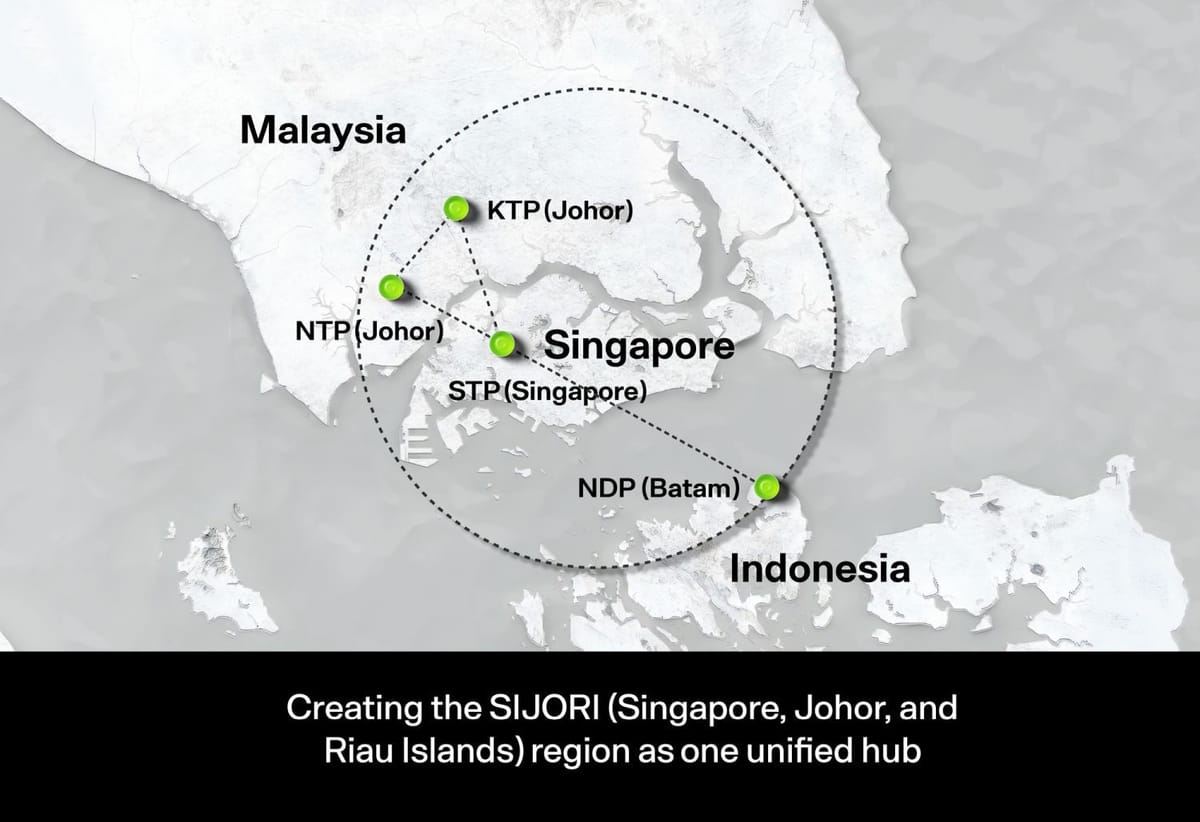

One key area of interest would undoubtedly be DayOne's focus on the SIJORI (Singapore-Johor-Riau Islands) region, a concept first mooted 3 decades ago.

For data centre deployments, the idea is to leverage the cost-efficiency and proximity of Johor and Batam to Singapore to serve customers in the region better.

DayOne has multiple data centres in SIJORI, though only the Johor ones are operational today.

- Nongsa Digital Park (NDP) in Batam (72.4MW)

- Nusajaya Tech Park (NTP) in Johor (~60MW).

- Kempas Tech Park (KTP) in Johor (~60MW).

- STP in Singapore (20MW)*

*Obtained under DC-CFA

Massive AI deployments

It is widely known within the industry that DayOne is a key hyperscaler partner for ByteDance, hosting large numbers of servers, including advanced systems for AI training.

The availability of land, power and water makes it easy to scale the data centres in Johor. Moreover, the proximity to Singapore and the diverse subsea connectivity there means your TikTok videos are easily delivered across the region.

An unconfirmed report I've heard cited tens of thousands of H100 GPUs running in DayOne's facilities in Johor. If true, this would make it the largest GPU deployment in Southeast Asia.

Storm clouds brewing

In the meantime, the US govt has introduced new regulations that seek to curb Chinese companies' sourcing of AI chips outside China.

The new regulations could potentially target Southeast Asia countries such as Singapore and Malaysia, which have been repeatedly fingered by Western media reports as key hubs used to potentially circumvent US export controls.

Where might this lead? I'm not sure. To my knowledge, the new regulations are not finalised at this moment.