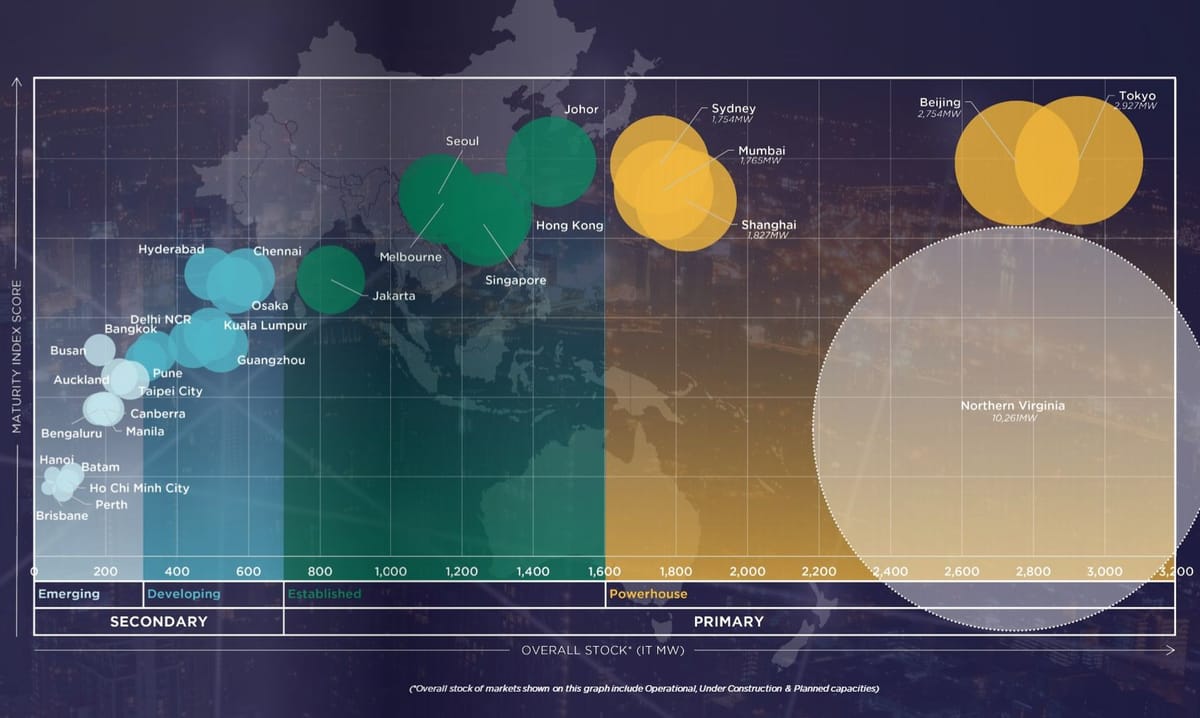

APAC data centre markets compared side-by-side

And other interesting nuggets from the Cushman & Wakefield APAC Data Centre Update.

How do APAC data centre markets like Singapore, Johor, Sydney, Shanghai, and Tokyo compare? This chart puts everything on one page.

The Cushman & Wakefield APAC Data Centre Update: H2 2024 contained very interesting tidbits of new data centres under construction and other data points.

Here's some noteworthy details - and probably worth hitting "save" for future reference.

APAC powerhouse markets

These are the largest data centre markets in the Asia Pacific region, in terms of operational capacity, operator presence, and growth potential.

As of end-2024, these markets accounted for 48% of the total operational capacity in APAC.

- Beijing*.

- Tokyo.

- Shanghai.

- Sydney.

- Mumbai.

*Beijing alone currently represents 17% of the region's total operational capacity.

Established markets

Established markets are those with a strong foothold in the region, and which are considered by operators as strategically important locations.

These account for a quarter (25%) of the region's operational capacity and almost a third (28%) of the development pipeline.

- Seoul.

- Hong Kong.

- Singapore.

- Melbourne.

- Johor*.

And yes, Johor, which had just one 10MW data centre in 2021, is now considered an established market a mere three years later.

Key APAC stats

Key statistics according to the report:

- 12,206MW of operational capacity.

- 14,462MW under development.

- 3,111MW under construction.

- 11,252MW in planned stages.

80% of APAC's data centre capacity is in:

- Chinese Mainland: 4.5GW.

- Japan: 1.5GW.

- Australia: 1.3GW.

- India: 1.3GW.

- Singapore: 1.0GW.

Singapore: No significant pipeline

Finally, what caught my attention was how Singapore was the only market in the mature category without any significant development pipeline.

Is this set to change soon with the 300MW for new data centres announced in May 2024 and the upcoming DC-CFA2?

And in case you missed it, Singapore's new emissions target submitted on 10 Feb is reduced from the previous 60 million tonnes in 2030, to between 45M and 50M tons.

What do you think? Will Singapore push ahead with more data centres to avoid losing the initiative in AI?

Get the Cushman report here.